ISVs face a churn crisis, but embedded finance offers a powerful retention lifeline—deepening customer relationships and driving long-term growth.

The SaaS world is a battlefield. Competition is fierce, and customer acquisition costs (CAC) are skyrocketing. In fact, the average CAC for B2B SaaS is $239, while for B2C SaaS it is $135. But what happens after you’ve poured your resources into landing that new client?

The fight to keep them begins. For Independent Software Vendors (ISVs), especially those serving small to medium-sized businesses (SMBs), the churn rate can feel like a tsunami threatening to wipe out hard-won gains.

Traditional retention strategies, often centered around feature upgrades and customer support, are proving insufficient. To truly combat churn and build lasting customer relationships, ISVs need a new lifeline.

That lifeline is embedded finance.

The Pain of Churn in the SaaS World

Churn, the rate at which customers cancel their subscriptions, is a constant drain on SaaS businesses. While an acceptable churn rate hovers between 5% and 7%, the reality for many ISVs is far more daunting. According to research from Recurly, the average churn rate across 1,200+ SaaS companies is 4.1%.

This includes a 3% voluntary churn rate and a 1.1% involuntary churn rate. A 2023 study by KBCM Technology Group found that the median gross dollar churn (the amount of revenue lost year-over-year) for private SaaS companies is 12%, and the median logo churn (the number of customers lost year-over-year) is 13%.

Losing customers means losing recurring revenue, hindering growth, and impacting profitability. Moreover, the cost of acquiring new customers continues to rise, making it even more critical to retain existing ones.

In the past five years alone, SaaS customer acquisition costs have increased by 50%. Some common factors that affect customer acquisition costs are money spent on marketing campaigns, advertising and social media strategies, sales staff salaries, customer service, and software and technology used for acquiring customers. Interestingly, SaaS companies with longer contracts report the lowest rate of churn.

Why Traditional Retention Strategies Fall Short

Many ISVs rely on feature-focused retention strategies, constantly adding new functionalities and improvements to their software. While this can be beneficial, it often fails to address the root causes of churn. Customers may leave due to factors beyond the software itself, such as:

- Poor customer experience: If customers feel undervalued or unsupported, they are more likely to churn.

- Unmet needs: The software may not fully address the evolving needs of the customer’s business.

- Pricing concerns: Customers may find the software too expensive or not provide sufficient value for the cost.

- Lack of engagement: Customers may not fully utilize the software or understand its value, leading to disinterest and eventual churn.

Furthermore, neglecting continuous product improvement and competitive analysis can also lead to customer churn. It’s crucial to understand that engaged customers represent a 23% premium in terms of share of wallet, profitability, revenue, and relationship growth compared to the average customer.

Focusing on customer retention is vital throughout a business’s development, from the early stages of ensuring user onboarding and demonstrating value to the later stages of retaining long-term users and advocates.

Embedded Finance: A Value-Added Solution

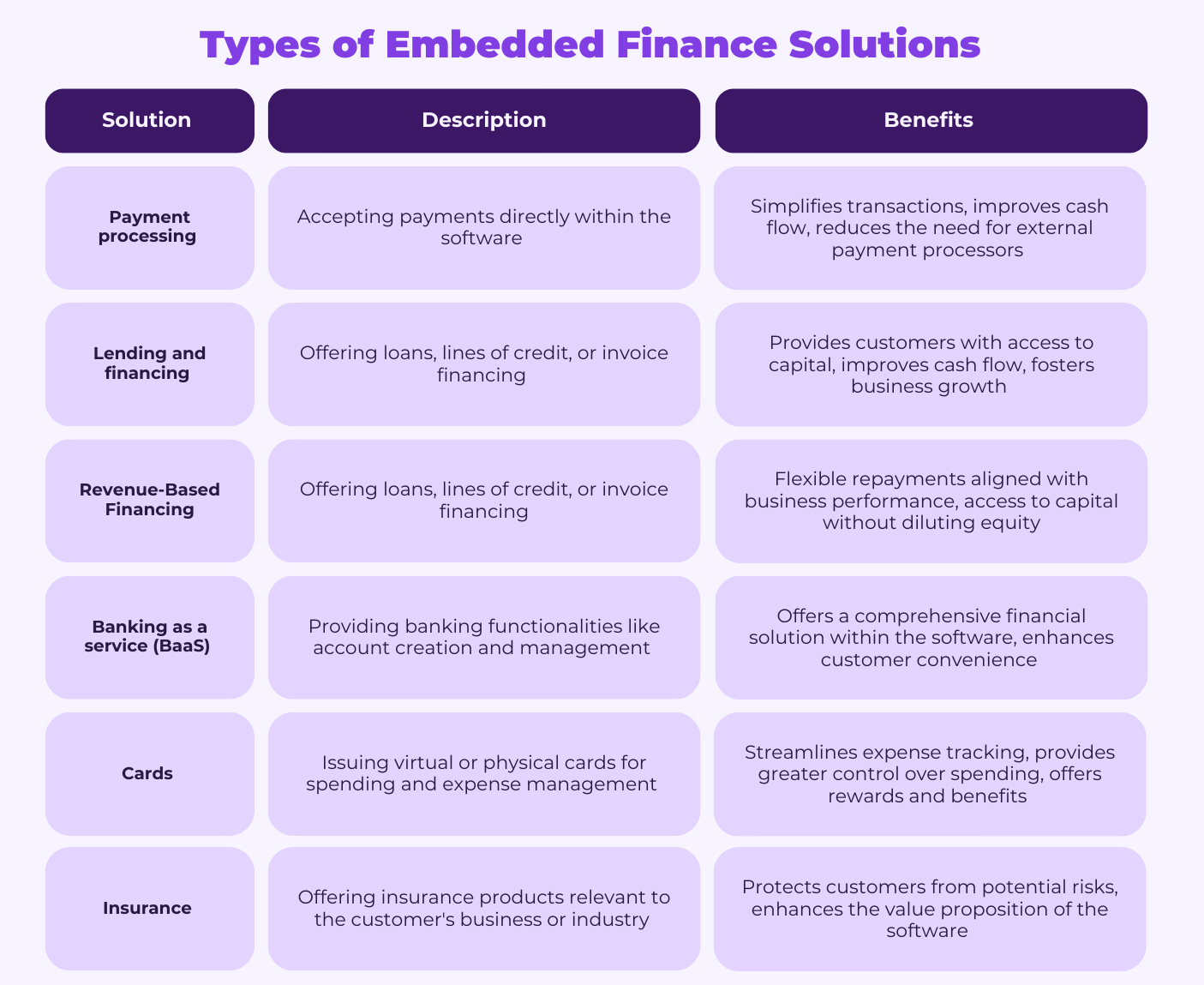

Embedded finance is the process of integrating financial services into non-financial platforms. For ISVs, this means offering financial products like payment processing, lending, and insurance directly within their software. This seemingly simple addition can have a profound impact on customer retention.

Benefits of Embedded Finance

Embedded finance offers a range of benefits for both ISVs and their SMB customers:

For ISVs:

- Deepened Customer Relationships: By offering financial solutions tailored to their needs, ISVs become more than just software providers; they become trusted partners invested in their customers’ success.

- Increased Stickiness: Embedded finance makes the ISV’s platform indispensable by providing essential financial tools in a centralized location. Customers are less likely to churn when their core business needs are met within a single ecosystem.

- Enhanced Value Proposition: Financial services add a new dimension to the ISV’s offering, making it more attractive to potential customers and increasing the lifetime value of existing ones. Brands embracing embedded payments see marked increases in customer lifetime value.

For SMBs:

- Improved Cash Flow: Access to funding and credit solutions can help SMBs manage their cash flow more effectively.

- Simplified Financial Management: Integrated financial tools streamline processes and reduce the need for multiple platforms.

- Increased Growth Opportunities: With readily available capital, SMBs can invest in expansion and seize new opportunities.

- Empowerment: Embedded lending empowers SMBs to design each step of the commerce experience to deliver the outcome they desire.

- Meeting Financial Needs: A significant number of SMBs – 65% in the US – partner with fintech companies outside their primary financial institution to meet their financial needs.

Embedded finance can also simplify the customer experience by shortening the steps required to complete a buying journey. For online purchasing, embedding payments can shorten the step required to complete a buying journey, enhance convenience, and reduce the risk of a customer not completing their transaction.

Examples of Embedded Finance in Action

Embedded finance has the potential to revolutionize the way businesses operate. Here are a few examples of how it can be applied:

- Accounting software with integrated lending: Imagine an accounting software that not only helps businesses manage their finances but also offers seamless access to business loans or lines of credit. This eliminates the need for businesses to go through a separate loan application process with a traditional bank, saving them time and effort.

- Project management tool with invoicing and payments: A project management tool that allows freelancers to invoice clients and receive payments directly within the platform streamlines the entire payment process. This reduces the need for freelancers to use separate invoicing and payment processing tools, simplifying their workflow and improving cash flow.

- Shakepay’s Bitcoin rewards card: Cryptocurrency platform Shakepay partnered with Marqeta to launch a prepaid Visa debit card that rewards cardholders with Bitcoin instead of traditional cashback. This innovative approach attracted a large number of customers and demonstrates how embedded finance can be used to make cryptocurrency more mainstream and accessible.

- Vagaro Capital, powered by Liberis: Vagaro, a leading software platform for the beauty and wellness industry, offers its merchants access to personalized funding through Vagaro Capital, powered by Liberis. This embedded finance solution allows businesses to access revenue-based financing directly within the Vagaro platform, streamlining the process and enabling growth.

Liberis: Making Embedded Finance Accessible

For ISVs looking to implement embedded finance, platforms like Liberis offer a streamlined solution. Liberis provides the technology and infrastructure to integrate financial services seamlessly into existing software. Liberis has developed a multi-product platform that uses AI-driven insights to offer personalized funding solutions. With Liberis, ISVs can:

- Go live quickly: A single API integration allows for rapid deployment of embedded finance solutions.

- Offer personalized funding: Liberis leverages data and insights to provide tailored funding options to each customer.

- Expand globally: Liberis operates in 13 markets, enabling ISVs to reach a wider audience.

It’s important to note that embedded finance isn’t a one-size-fits-all solution. Liberis understands this and tailors its offerings to different types of merchants, including those with thin credit files, high-growth merchants, and opportunity merchants.

Riding the Wave of Embedded Finance

The churn tsunami is a real threat to ISVs in the current SaaS landscape. The increasing cost of customer acquisition, combined with the challenges of retaining customers in a competitive market, requires a new approach to customer relationships.

Embedded finance offers a powerful solution to these challenges. By integrating financial services into their platforms, ISVs can deepen customer relationships, enhance their value proposition, and ultimately, turn the tide of churn.

This creates a win-win situation for both ISVs and their SMB customers. ISVs benefit from increased customer retention and lifetime value, while SMBs gain access to valuable financial tools and resources that can help them grow and thrive.

With platforms like Liberis making embedded finance accessible, there’s no reason for ISVs to be swept away. Instead, they can ride the wave of this innovative trend towards greater customer retention, increased revenue, and sustainable growth.

ISVs should explore the potential of embedded finance and consider Liberis as a potential partner in their journey towards building a more robust and customer-centric business model.

Leave a Reply